-

-

South African actors who’re bad kissers

Posted on Aug 13, 2022 -

Metro FM Fires Mpho Madise aka Mo G

Posted on Jul 31, 2022 -

Miss SA Zozi Tunzi gets trolled for her outfit ..

Posted on Aug 10, 2022 -

‘I have dated a lot of rich men, but I’m not a ..

Posted on Aug 27, 2022 -

South African actors who are related in real life

Posted on Aug 17, 2022 -

Gomora actresses Thathi ‘Katlego Danke and Gugu ..

Posted on Jul 22, 2022 -

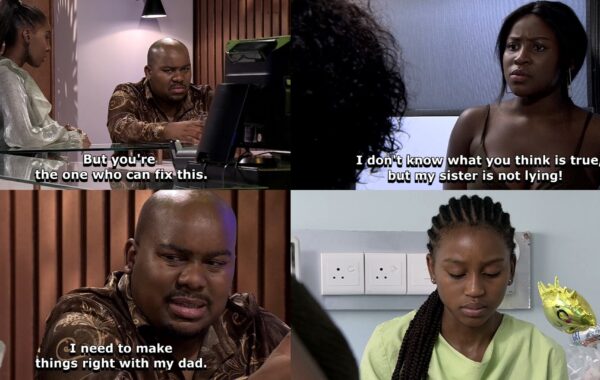

Coming Up Next On #etvScandal 15 :19 April 2024

Posted on Apr 14, 2024